What Is a Bank?

A bank is a legal entity that takes deposits that may be withdrawn at any time. Banks are institutions that assist the public in the management of their finances. The public deposits its savings in banks with the certainty that they would be able to withdraw money from the deposits when needed.

Banks accept deposits from the general population as well as the business community and provide depositors with two guarantees:

- Deposit security

- Withdrawal of deposits as needed

Banks pay interest on deposits, which increases the original deposit amount and provides a significant incentive to the depositor. This encourages people to save money. Banks also make loans based on deposits, contributing to the country’s economic progress and the general public’s well-being. With this level of responsibility, it is critical to grasp the key operations of a bank.

Click here to know more about HSN Code for grains and cereals.

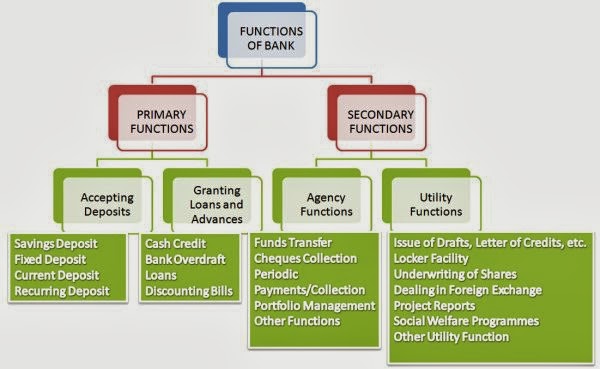

Important Functions of Bank

Primary Functions of Bank

All banks must carry out two basic fundamental functions:

- Accepting of deposits

- Granting of loans and advances

Accepting of Deposits

Mobilizing public money, guaranteeing secure custody of savings, and paying interest to depositors is a fundamental yet critical duty of all commercial banks. The bank takes many sorts of deposits from the general public, including:

- Saving Deposits – urges the general populace to save. It is appropriate for salaried and wage earners

- Fixed deposits – Term deposits are another name for them. Money is placed for a set period of time. During this time, no money may be withdrawn

- Current deposits – Businessmen are the ones who open them. On this account, account holders have access to an overdraft facility

- Recurring Deposits – At regular intervals, a fixed amount of money is placed in the bank

Granting of Loans & Advances

Banks use public deposits to lend to companies and people to help them weather economic storms. Banks impose greater interest rates on loans and advances than on deposits. Bank profit is the difference between lending and deposit interest rates.

Loans and Advances offered by Bank include:

- Bank Overdraft – Current account holders only. It permits holders to withdraw funds up to the specified limit

- Cash Credits – A short-term borrowing arrangement with a defined limit. Banks allow customers to borrow against a mortgaged property

- Loans – Banks lend money to customers for 1 to 5 years against physical assets

- Discounting the Bill of Exchange – Short term loan when the vendor discounts the bank bill for some costs

Secondary Functions of Bank

The secondary functions of a bank are divided into two categories:

- Agency functions

- Utility Functions

Agency Functions of Bank

- Transferring money from one branch to another.

- Monthly, quarterly, and annual collections on behalf of clients.

- Making recurring payments on behalf of the customer for rent, utilities, etc.

- Collection of Cheques: The bank collects money from cheques through the clearing department of its clients.

- Banks manage their clients’ portfolios. It buys and sells customers’ shares and debentures and debits or credits their accounts.

Utility Functions of Bank

- Authorizing traveller’s checks, etc

- Providing safe deposit vaults or lockers for valuables, essential papers, and securities

- Providing foreign exchange services to clients

- Share and Debenture Underwriting

- Exchanging currencies

- Services for the poor

- Projects reports

- Standing assurance for its clients, etc

Downloading Payment Voucher Format – Click here